Logistics trends in Italy: Q1 analysis

This article involves contextual analysis of logistics trends in Italy based on the first quarter of the financial year. It originally appeared in our Italian blog on 5th May 2023.

The Italian logistics market in early 2023 will remain in line with 2022 but will experience a phase of investment awakening starting from the second quarter of the year. The first three months have seen a confirmation of development volumes, particularly in core markets, and growing interest in new opportunities in southern Italy. Notably, GLP has completed two major acquisition operations in Fiorenzuola and Caronno Pertusella, which are significant for the market.

From the occupier perspective, the first quarter of 2023 marks a slight decline (17%) in signed lease contracts, but it is a reassuring figure compared to the record-breaking year of 2022. The take-up stands at 623,000 sqm.

In these trends, we read a strong demand for space from users, whose profile has remained unchanged. It still mainly involves e-commerce operators, 3PL, and generally large-scale retailers. In particular, our market vision, which predicted a confirmation of e-commerce growth, has been confirmed.

It is highlighted that the post-pandemic reorganization of large-scale retail in general is also impacting the logistics sector’s performance, with numerous tenders issued for the search of new warehouses by industry operators, from regional discount stores to large national chains.

Progress in the development sphere

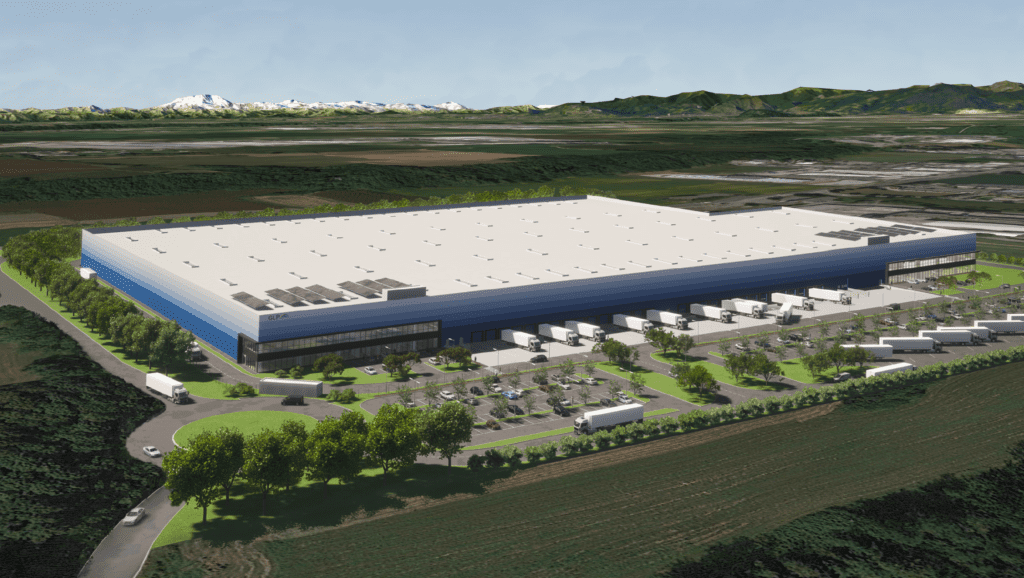

In terms of developments, the first quarter of 2023 has confirmed expectations. The average size of warehouses is generally increasing, with 66% of the take-up volume coming from assets larger than 20,000 square meters. In the first few months of 2023, the market has seen the development of warehouses over 50,000 square meters, as well as three of the six warehouses that GLP is about to build in Italy.

The take-up volume remains substantially unchanged geographically in the Italian core markets: Milan (37%), Veneto (11%), Bologna (7%), and Rome (11%). From this year, the institutional logistics border is moving further south along the peninsula, towards markets where demand is growing. New markets are opening up, especially in Campania and Puglia.

Moreover, exponential increases in rents are observed in primary markets, which have grown by over 15% in the last 6 months. On average, for prime sectors, the value is €65/sqm/year, and GLP can confirm the value’s trend, a consequence of a very limited vacancy rate and construction costs that remain at historical highs.

Investment trends in Italian logistics

Investment activity has slowed down in the first quarter compared to previous years. GLP is an exception in the Italian landscape, being one of the few operators active in the first few months of 2023 with two major operations, namely the acquisitions of Fiorenzuola (PC) and Caronno Pertusella (VA). However, the investment market is awakening in these weeks, and we expect growth in the second quarter of the year because there is still an appetite among investors for logistic assets, with a maximum focus on quality and ESG specifications.

In the coming months, GLP Italia’s vitality in the Italian logistics landscape will be confirmed. In fact, the development projects in the pipeline will continue, totaling 6. Additionally, negotiations for the lease of structures in Valsamoggia (BO), Filago (BG), Colleferro (RM), and Anagni (FR) have entered a concrete phase.

We confirm the trends and do not expect a decrease in rents, despite the slight slowdown in the first months of 2023. Demand remains high, particularly for prime locations of modern and high-quality warehouses, grade A, and with BREEAM new construction certifications at the ‘Excellent’ level.

If you would like to know more about GLP Italia, visit their webpage.

Source of data: CBRE